Keeping your bank statements organized is essential for effective financial management, whether you’re tracking personal expenses, managing a small business, or preparing for tax season. A well-structured system can save time, reduce stress, and ensure you have access to important financial information when you need it. Using a tool like Rocket Statements can help streamline this process, making it easier to store, search, and retrieve your statements when needed. Here’s a step-by-step guide to organizing your bank statements efficiently.

1. Choose a Storage Method

The first step is deciding how you want to store your bank statements. Many people prefer digital storage, physical storage, or a mix of both.

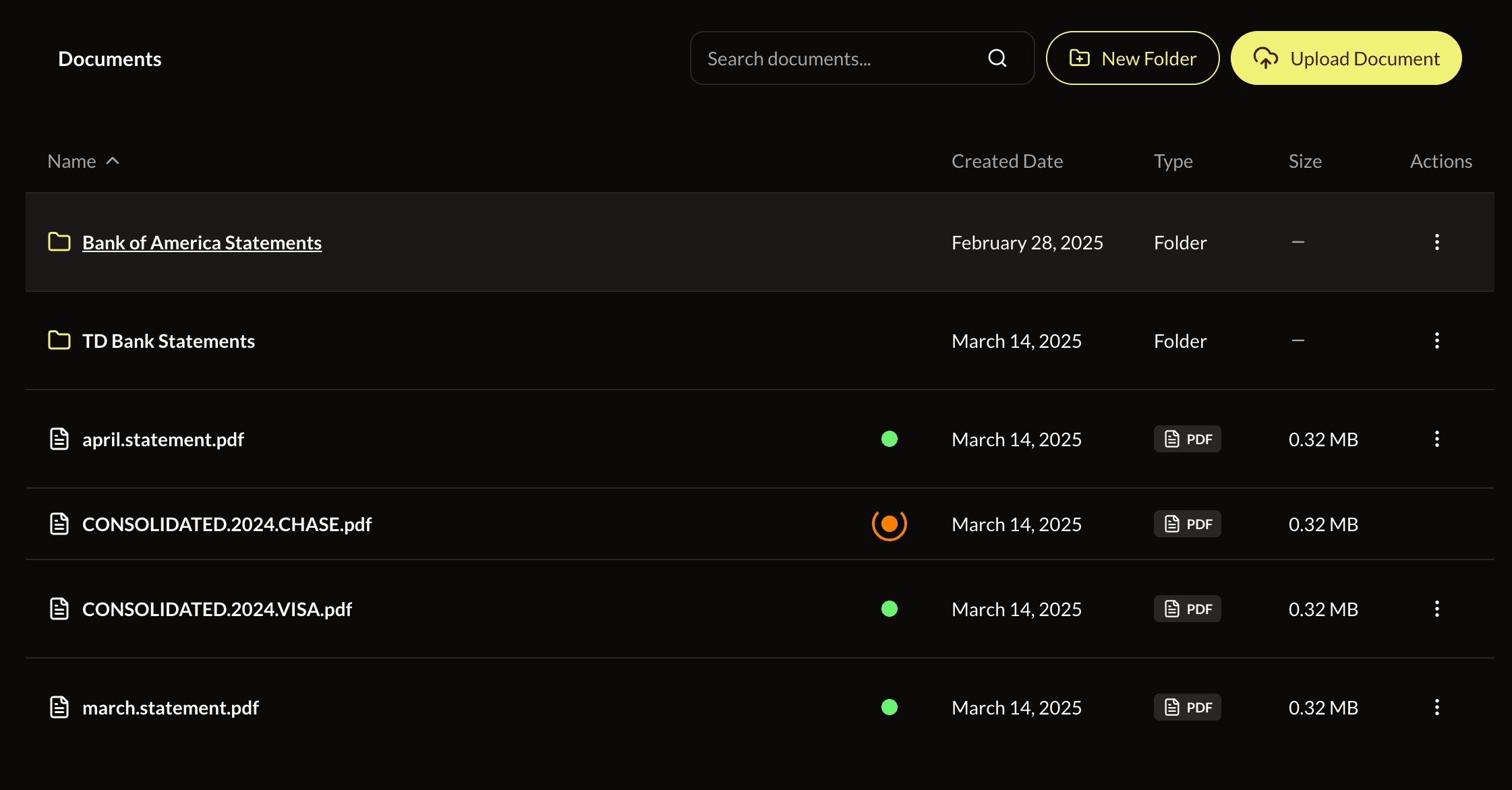

- Digital Storage: If you receive e-statements, keeping them in a dedicated folder system can be helpful. A platform like Rocket Statements can automatically sort and categorize these files, making them easier to locate later.

- Physical Storage: If you prefer to keep paper records, consider digitizing them. Scanning statements and uploading them into an organized system ensures you have backups in case of loss or damage.

- Hybrid Approach: Combining both methods allows you to keep digital copies while storing important physical records securely.

2. Sort Statements by Date

Organizing your statements chronologically is key to quick retrieval. Ideally, you should structure them by year and month so you can easily find past records when needed.

- Creating folders labeled by year, with subfolders for each month, ensures a logical structure.

- If you’re using a digital platform, automated sorting features can help maintain this organization without extra effort.

3. Categorize by Account Type

If you have multiple bank accounts, it’s useful to group statements by account type (e.g., checking, savings, business). This way, whether you’re reviewing transactions for personal or business expenses, you can quickly find the relevant records.

4. Label Statements Clearly

A consistent file naming format makes it easier to search for statements later. For example:

2024-03_Bank-XYZ_Checking.pdf (Year-Month_BankName_AccountType)

If you’re using a document management tool, file names and metadata can often be generated automatically, reducing the need for manual input.

5. Automate Where Possible

Rather than manually downloading and organizing statements each month, automating the process can save time. Some platforms allow you to set up automatic imports for bank statements, categorizing them as they come in. This ensures your records are always up to date without extra effort.

6. Implement a Retention Policy

Decide how long to keep your statements based on your needs:

- Personal accounts: Keeping records for at least one year is usually sufficient.

- Tax purposes: Retaining statements for 3-7 years can be helpful for audits or financial reviews.

- Business accounts: Many businesses keep financial records for at least 7 years to comply with regulations.

A structured system makes it easier to clean up old records while ensuring you keep important ones accessible.

7. Ensure Security

Since bank statements contain sensitive information, security should be a priority:

- Use password-protected folders for digital files.

- Enable two-factor authentication for cloud storage accounts.

- Keep physical copies in a locked, fireproof safe if necessary.

Platforms that offer secure encryption and controlled access can provide additional peace of mind when managing digital statements.

8. Regularly Review and Reconcile

Setting aside time to review your bank statements each month can help catch errors, identify fraudulent transactions, and stay on top of your finances. If you use an automated system, features like transaction alerts or reconciliation tools can help streamline this process.

Final Thoughts

An organized system for managing bank statements makes financial tracking much easier. Whether you prefer manual organization or automation, having a structured approach ensures that your records are easy to find when needed. If you want to simplify the process further, using a tool that categorizes and secures your statements can help keep everything in order without the hassle.

For more financial organization tips, check out Rocket Statements and see how a structured system can make managing your financial records easier.